Understanding Debt: The First Step to Financial Freedom

Debt is a complex but common aspect of modern financial life, and understanding its various forms is crucial for anyone aspiring to achieve financial freedom. Individuals may encounter several different types of debt, including student loans, credit card debt, personal loans, and mortgages. Each type has its own implications and characteristics. For example, student loans typically have lower interest rates compared to credit cards, which often carry high-interest rates that can compound rapidly if not managed properly.

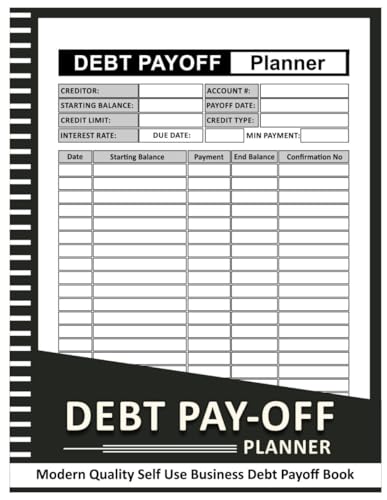

Recognizing and acknowledging your personal debt situation is an essential first step in the journey toward financial stability. Understanding how much you owe and the terms associated with each debt type is vital. Calculating total debt and evaluating monthly payments can provide you with a clearer picture of your financial circumstances. It is advisable to list all debts and their respective interest rates, as this aids in prioritizing which debts need to be addressed first.

Creating a budget is a powerful tool that can help manage and reduce debt effectively. A well-structured budget allocates your income towards essential expenses, savings, and debt repayment. Prioritizing minimum payments on all debts while directing any additional funds towards the debt with the highest interest rate is a commonly recommended strategy, often referred to as the “avalanche method.” Alternatively, some individuals may prefer the “snowball method,” which suggests paying off smaller debts first for quick victories that can boost motivation.

As you embark on the path from debt to wealth, arming yourself with knowledge about your financial obligations is the key to strategic planning. By understanding the kinds of debt you have and employing practical budgeting techniques, you will be well-equipped to take the necessary actions toward achieving financial independence. This understanding is a crucial step toward building a prosperous future.

Effective Strategies for Getting Out of Debt

Achieving financial freedom and moving from debt to wealth requires a strategic approach to eliminating outstanding obligations. One widely endorsed method is the snowball technique. This involves listing debts from the smallest balance to the largest and focusing on paying off the smallest debt first while making minimum payments on larger debts. Once the smallest debt is cleared, funds can be redirected towards the next smallest debt. This strategy not only reduces the total number of debts but also provides psychological motivation as each debt is eliminated.

Alternatively, the debt avalanche technique prioritizes debts based on interest rates. By focusing on paying off high-interest debts first, individuals can save money on interest over time. This method may take longer to see some progress, but it is often more cost-effective in the long run. Both strategies require discipline and commitment, along with a well-planned budget that allocates funds effectively towards debt repayment.

Negotiating with creditors is another critical strategy in the debt repayment process. Many financial institutions are willing to work with individuals facing financial difficulties. Reducing interest rates, settling for a lower total payment, or establishing a manageable payment plan can significantly aid in debt elimination. Open lines of communication with creditors can sometimes lead to more favorable terms, reducing overall financial strain.

In addition to these methods, making lifestyle adjustments can play a vital role in freeing up funds for debt repayment. Cutting unnecessary expenses and focusing on basic needs can yield substantial savings. Individuals might also consider increasing their income through side hustles or second jobs, which can provide additional cash flow to tackle debts more aggressively. Finally, seeking guidance from financial advisors or debt counseling services can offer expert strategies tailored to one’s unique circumstances, facilitating a smoother path towards financial stability.

Building Your Savings: A Solid Foundation for Your Future

Once debt is effectively managed or eliminated, transitioning towards building a robust savings foundation becomes imperative. Establishing an emergency fund is often the first step in this financial journey. A general guideline suggests saving three to six months’ worth of living expenses. This cushion can provide a sense of security during unexpected financial emergencies such as medical expenses or job loss. Having this fund not only protects financial stability but also cultivates a proactive mindset towards savings.

In addition to an emergency fund, setting clear savings goals is essential. Short-term goals might include saving for a vacation or new appliance, while long-term objectives could involve down payments for a home or retirement planning. Creating specific and measurable goals increases motivation and provides a road map to track progress effectively. It is beneficial to regularly review and adjust these objectives as financial situations and priorities evolve over time.

Selecting the right savings account can also enhance your savings strategy. High-yield savings accounts typically offer better interest rates than traditional accounts, allowing your money to grow more effectively. Similarly, money market accounts provide access to funds with the potential for higher returns, albeit with higher required balances. These accounts not only serve as a place to store your savings but also help avoid the temptation to spend while providing liquidity when necessary.

Automating your savings is a practical strategy that ensures consistency in saving efforts. Setting up automatic transfers from checking to savings accounts on a regular basis simplifies the process and integrates saving into your financial routine. Furthermore, the psychological benefits of saving should not be overlooked. Regular contributions to savings can enhance financial confidence, reduce anxiety, and foster a more positive relationship with money, thereby reinforcing the habit of saving and establishing a solid financial foundation for the future.

Investing for Your Future: Making Your Money Work for You

Once you have successfully managed your debt and established a savings foundation, the next significant step in your financial journey is investing. The primary objective of investing is to make your money work for you by generating returns that outpace inflation while securing your financial future.

One of the fundamental principles of investing is to start early. The earlier you begin investing, the more you will benefit from the power of compound interest. This concept highlights how your investment gains earn additional returns over time, creating a snowball effect that can substantially increase your wealth. Even small amounts can grow significantly when given sufficient time to compound.

There are several investment options available, each with its own risk and return characteristics. Stocks are known for their potential for high returns, but they come with increased volatility. Bonds, on the other hand, generally offer lower returns but are considered a safer option. Mutual funds allow for diversification by pooling resources from multiple investors to buy a variety of assets, while real estate investing provides tangible assets that can appreciate over time and generate rental income.

Building a diversified investment portfolio is vital in balancing risk and return. Diversification involves spreading your investments across different asset classes and sectors, minimizing the impact of a poor-performing investment. Additionally, understanding risk management is essential to protect your assets and ensure sustainable growth. Asset allocation—deciding how to distribute investments among various asset classes—should reflect your financial goals, risk tolerance, and time horizon.

Lastly, continuous education in the investment landscape is crucial. Staying informed about market trends, economic indicators, and investment strategies equips you to make wise decisions. With ongoing learning and a disciplined approach, you can navigate the complexities of investing and work towards achieving long-term financial freedom.